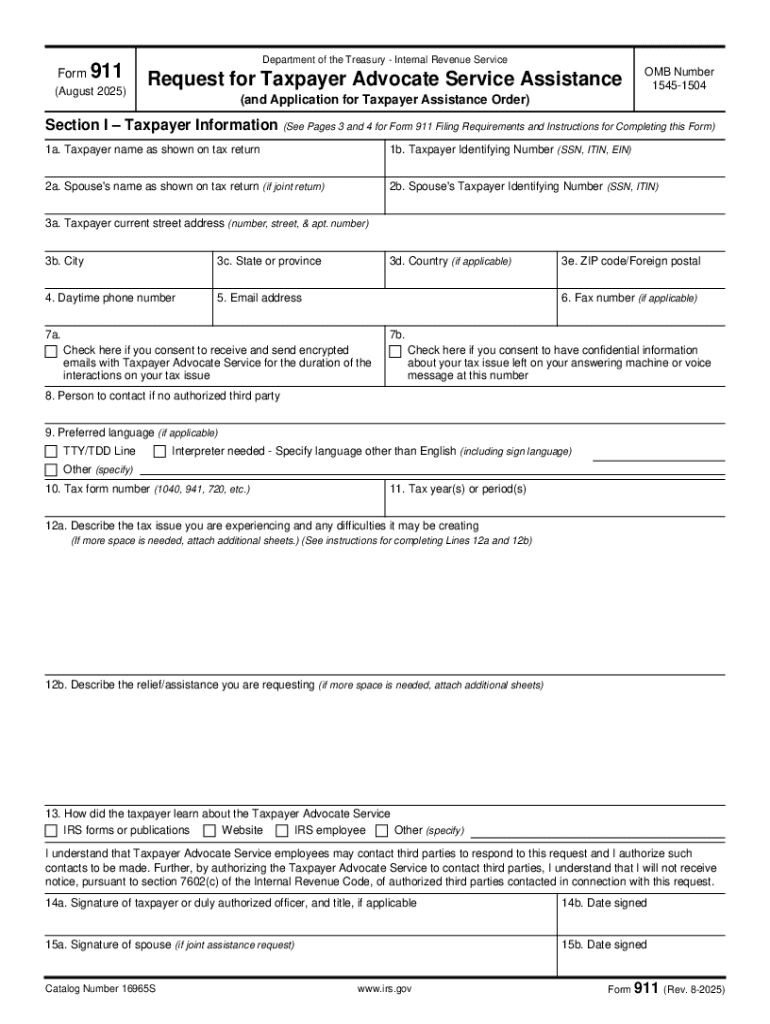

IRS 911 2025-2026 free printable template

FAQ about IRS 911

What should I do if I realize I've made an error on my IRS 911 after submission?

If you've made a mistake on your IRS 911, you can amend the form by submitting a corrected version. It’s important to notify the IRS of any errors to avoid potential issues or penalties. Ensure you keep records of both the original and amended forms for your records.

How can I check the status of my IRS 911 submission?

To verify the status of your IRS 911 submission, you can use the IRS online tracking tool available on their website. This service allows you to see if your form has been received and is being processed. Be prepared to enter your personal information as specified.

What should I do if my IRS 911 submission is rejected?

If your IRS 911 is rejected, review the rejection codes provided to understand the reason. You may need to correct specific information and resubmit the form. Make sure to keep a record of the rejection notice for your files.

Are e-signatures acceptable when filing IRS 911?

Yes, e-signatures are accepted for filing the IRS 911, provided they are compliant with IRS guidelines. It is crucial to ensure that the signing method you use meets the security and identification standards set by the IRS to avoid potential issues.

See what our users say